Author: Yuqi Shi

Hong Kong Executive Council announced the new vacancy tax on June 2018. The levy gives developers 12 months after a new building’s occupation permit is issued to sell or lease out all the units. After this grace period, the vacancy tax will be levied at the rate of 200% of the unsold homes’ rateable value. Chief Executive Carrie Lam said that “The purpose of the new vacancy tax is not to dent soaring housing prices, but aiming to adjust the supply structure of the real estate market”.

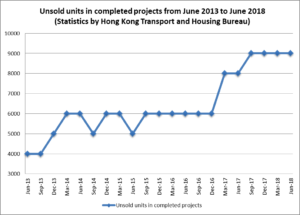

Hong Kong’s dense population and limited land resources (Rigid demand exceeds supply) result in a severe housing shortage. However, approximately 9,000 vacant flats (Figure 1) were left from September 2017 to June 2018 and held by property developers, which is indeed “significant data” compared with the government’s goal of adding 18,000 flats to the housing supply per year. This interesting phenomenon can be mainly attributed to apartment hoarding by developers in order to fetch higher prices under Hong Kong’s bull property market in recent years. Hang Lung Properties, for example, built The Long Beach in Tai Kok Tsui in 2015 but still has not sold all of the flats. Hong Kong Financial Chief Chan Mo-Po said in February 2018 that “The number of unsold units in completed projects had been rising (Figure 1) while the government was breaking its back to increase housing supply.”

Figure 1: Unsold units in completed projects

Therefore, unlike most taxes, developers, long criticized for hoarding flats, are the target of the new vacancy tax. The government intended to encourage developers to offload inventory more quickly and expedite the supply of first-hand private flats to satisfy market demand (the secondary property market would not be affected).

Hong Kong’s vacancy tax also provides inspiration for real estate development in mainland China, said by State Council Counsellor Qiu Baoxing, although the applicable part of the vacancy tax is different.

Under the red-hot property market in Mainland, many Chinese can’t afford expensive housing prices and rents, while the urban housing vacancy rate exceeds 20% in recent years (higher than the international warning line), which demonstrates the irrationality of housing usage. Currently, many government officials strongly suggest the vacancy tax. On one side, real estate speculation can be curbed. On the other, it helps to adjust the housing rental market, promoting the release of housing resources from the leasing market, reducing the housing rents reasonably, and protecting the housing needs of low-income people.

Personally, the promotion of vacancy tax in China has many positive effects. The vacancy tax promotes the adjustment of the supply structure (Hong Kong) and improves the reasonable use of housing (Mainland), which is conducive to the more reasonable future development of the real estate industry. From a political perspective, the vacancy tax shows that the government is shifting its policy priority towards protecting the basic housing needs of the people, which is very commendable and affirmative, and it’s more important than simply suppressing house prices.

Further Reading:

<https://www.thb.gov.hk/eng/psp/publications/housing/private/pshpm/previous_stat.htm>